[

] 84

women. For instance, between 2002 and 2012, AfDB financed

over 90 microfinance projects worth over US$400 million, of

which the lion’s share was dedicated to women.

6

AfDB interven-

tions also include support for women-owned small and medium

enterprises which most often takes the form of lines of credit to

financial institutions for on-lending to eligible enterprises.

A review of the AfDB Gender Equality Index summarized

performance of the 54 African countries during the period

2011-2015 revealed that while access to a loan from a financial

institution for women of 15 years old and above is highest

in West Africa, loan access is not negligible in Northern and

Eastern Africa where it is the lowest. An important caveat to

these survey results is that access to a loan does not necessar-

ily imply the ability nor the capacity wherewithal (contract

negotiation, financial knowledge, collateral and so on) that

are required to approach a formal financial institution for a

loan for personal or business purposes. This is further proved

by the Global Findex which reveals that women are less likely

than men to have a formal bank account,

7

which is the first

step to applying for a loan from a financial institution.

An FSD Africa study in Mozambique concluded that

women’s levels of education and product awareness are lower

than men’s (33 per cent) and women are less likely to turn

to banks for financial advice than men. Additionally, they are

less aware of the advantages of having a bank account, less

likely to know or visit financial services access points and less

likely to have either identity documents or proof of residen-

tial address.

8

In Mauritius, Zambia, Tanzania and Zimbabwe,

females report inability to maintain the minimum balance as a

barrier to having a bank account.

9

One can safely deduct that

the root cause of women’s economic empowerment is zero

or low starting capital/finances and wealth. These findings

collectively point to the need for the AfDB, national govern-

ments, regional bodies, the private sector and the development

community to adopt initiatives that will strategically address

the root causes of women’s poverty in Africa.

Cognizant of the need for more catalytic action and more

targeted interventions to address economic empower-

ment of women in Africa, the bank launched its Gender

Strategy, themed ‘Investing in Gender Equality for Africa’s

Transformation’, in 2014. The bank has since adopted a holis-

tic multisectoral approach to enhancing women’s economic

empowerment to level the playing field for men and women for

opportunities to engage in economic activities and earn income.

Five strategic areas of engagement

10

have been identified in

promoting women’s economic empowerment. The Gender

Strategy focuses on three pillars – legal status and property

rights; economic empowerment; and knowledge management

and capacity building.

Institutionally, AfDB also adopted its ‘High Five’ priorities

in September 2015: Light up and power Africa; Feed Africa;

Industrialize Africa; Integrate Africa; and Improve the quality

of life for the people of Africa. These five priorities link directly

with the Gender Strategy’s implementation approaches and

the United Nations Sustainable Development Goals. Given

that agriculture is the mainstay of women’s incomes in Africa,

initiatives particularly address constraints faced by women in

Côte d’Ivoire: Emerging from Conflict

The focus of Emerging from Conflict, a gender-based component

of a multisector support project, was to provide services to and

empowerment of victims of gender-based-violence during the period

December 2007 to December 2012. This project was launched after

the political crisis in Côte d’Ivoire in 2001 that saw gender-based

violence grow to affect 67 per cent of women. The project specifically

established integrated service centres for medical, psychosocial,

economic, legal and judiciary services for gender-based violence

survivors. It also established income-generating projects for women’s

associations where gender-based violence victims were encouraged to

join, empowering them economically and limiting the harm caused by

isolation and social stigma. To ensure continuity, the project trained six

non-governmental organizations (AWECO; l’Organisation Nationale pour

l’Enfant, la Femme et la Famille; l’Organisation pour le Développement

des Activités des Femmes; Cases; Horizon Vert; and Organisation pour

les Droits et la Solidarité en Afrique). The project was declared winner of

the United States Treasury Development Impact Honors in 2013.

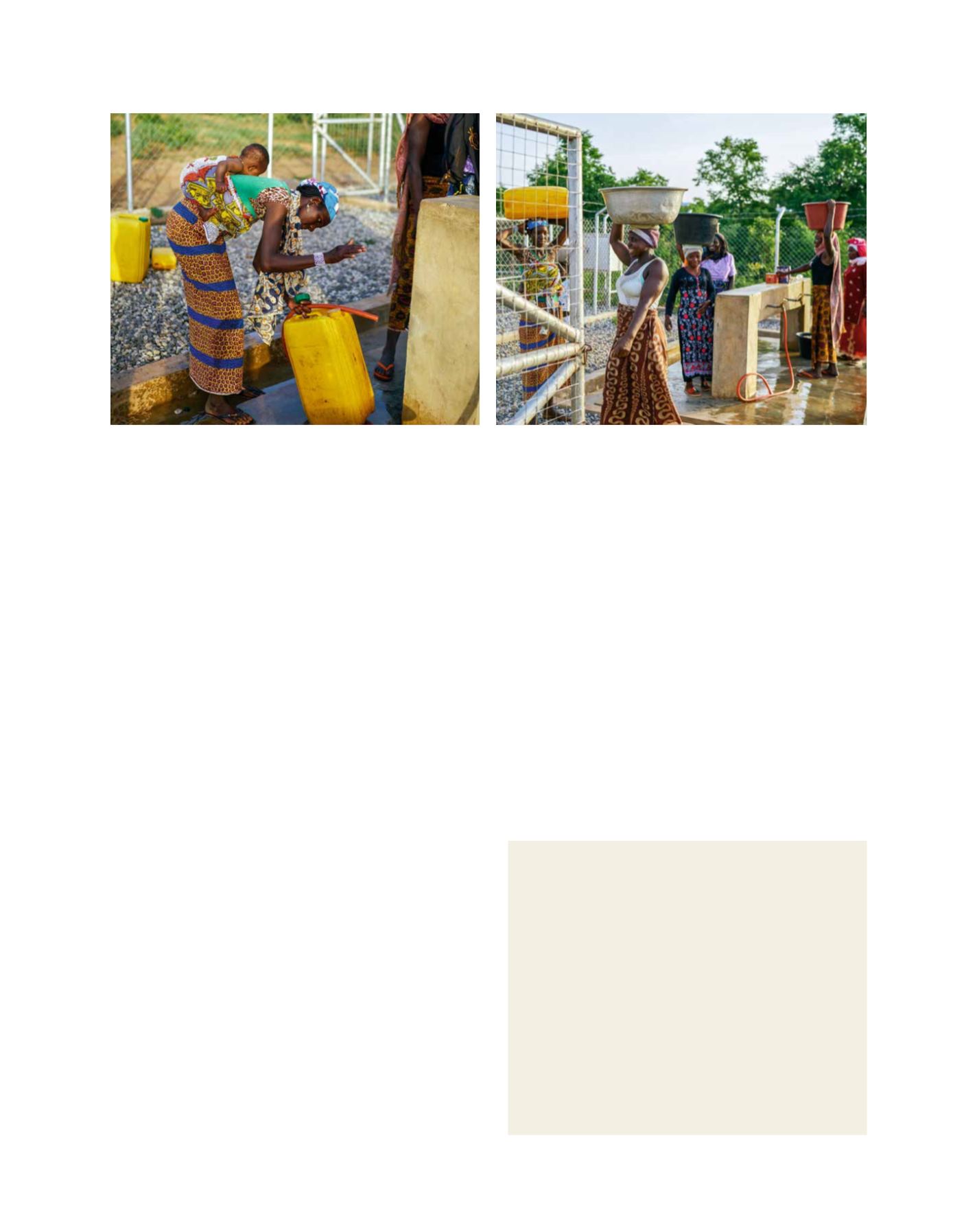

Ghana: sheltered stalls with water supply and sanitary facilities are generating positive impacts for women

Images: AfDB

A B

etter

W

orld