[

] 58

access

to

water

and

sanitation

for

all

to improve their water and sanitation infrastructure and are

able to repay these loans. A majority of WaterCredit borrow-

ers (55%) are living on under US$1.90 per day. Only less than

1% of very poor water and sanitation loan recipients were

delinquent over 30 days. Not only do these clients belong to

poor households, a key aspect is that over 90% of these loans

are borrowed by women. Table 1 shows the key character-

istics of loan portfolios across major countries where loans

were disbursed under the WaterCredit program.

Apart from direct benefits in terms of improved water

and sanitation facilities, household investments in access

to water and sanitation have shown to produce significant

returns, including socio-economic and health impacts. In

a recent evaluation in India, around 25% of WaterCredit

borrowers reported reduced illness and one in five reported

reduced medical expenses. Previous studies have shown that

reducing illness improves children’s school attendance and

lifetime earning potential. Access to improved water and

sanitation also reduces the incidence of chronic diarrhoea,

which correlates to improved cognitive function and reduced

risk of impaired growth. Research suggests that impaired

growth decreases the likelihood that children will lead

healthy, economically productive lives.

Access to improved on-site water and sanitation brings

dignity, safety, and privacy to the family, especially for

women, children, and the elderly. External evaluations of

WaterCredit interventions show that women with a toilet in

the home are safer and have more privacy than those who

must find isolated locations far from the home to defecate.

Around 39% of sanitation loan recipients reported increased

safety, after acquiring a toilet at home

4

.

A large percentage of households with improved access

to water and sanitation have experienced increased house-

hold income. Before taking a loan, only 53% of WaterCredit

borrowers in India made at least US$47 per month; after the

loan, this proportion nearly doubled to 97%, suggesting that

the investment in water and/or sanitation may have contrib-

uted to households’ abilities to generate income. According to

the WaterCredit impact evaluations, nearly 25% of borrow-

ers attributed increased income to extra time for women,

regained from minimised water collection times. Similarly,

one in five attributed increased income as a result of increase

in overall productivity due to fewer negative health impacts

from water or sanitation

4

.

Lessons and challenges

A joint World Bank and Water.org study found that microfi-

nance is a key tool in breaking down the barriers that prevent

those at the bottom of the economic pyramid from accessing

improved water and sanitation

5

. In reaching more than 7.1

million people through WaterCredit, Water.org has grasped

a better understanding of the factors required for increased

sustainability and scalability of WaterCredit operations and

has made and proven the case for WSS financing. A recent

evaluation of a WaterCredit intervention in India showed that

trained MFI staff and self-help groups were valuable change

agents in their communities, helping to drive behaviour

change and providing necessary product information

5

. The

intervention’s success in the notoriously challenging state of

Odisha also demonstrates that there can be a healthy demand

for WSS microfinance, even in areas that are deemed to have

less favourable microfinance environments

6

.

To address sustainability and scalability, a recent case

study

7

outlined the major enablers and constraints identified

in WaterCredit partners in India. Among the factors, access

to loan capital was identified as a major constraint by half of

the India WaterCredit partners in the study, largely due to

reluctance among commercial banks to finance WSS port-

folios. However, the inclusion of WSS in the Reserve Bank

of India’s Priority Sector Lending in April 2015 has enabled

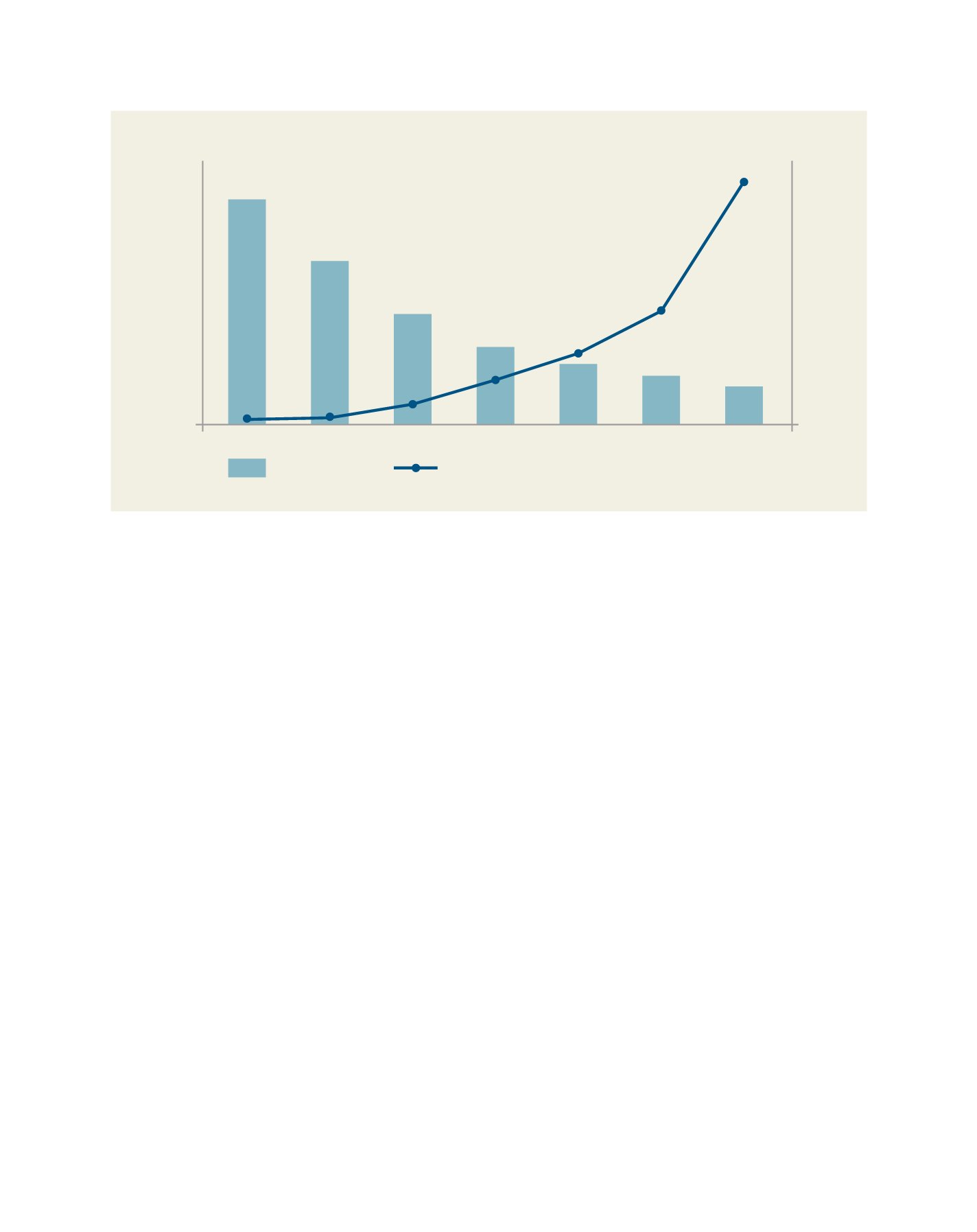

$500

$450

$400

$350

$300

$250

$200

$150

$100

$50

$0

$18.00

$16.00

$14.00

$12.00

$10.00

$8.00

$6.00

$4.00

$2.00

$0.00

FY04–11

Loan amount disbursed (Millions)

Loan amount disbursed

Cost per person

$15.48

$11.15

$7.66

$5.37

$4.17

$463,463,229

$220,491,990

$139,184,598

$87,283,759

$40,475,340

$13,054,414

$6,306,107

$3.45

$2.72

FY11

FY13

FY14

FY15

FY16

FY17

Fig 2: Cumulative cost per person under the WaterCredit program, as of August 2017

Source: Water.org