[

] 59

A B

et ter

W

or ld

more capital to be unleashed towards WSS portfolios. By

reaching more than half a million households in just four

years with a unit cost significantly lower than traditional

WSS programs, WaterCredit in India demonstrates that

microfinance can significantly amplify the reach and impact

of investments in the WSS sector.

On a global level, multilateral stakeholders like the World

Bank stress the role of blended finance – the strategic use of

development finance and philanthropic funds to mobilise

private capital flows to emerging and frontier markets

8

– in

achieving SDG 6. It has been touted as an effective tool for stim-

ulating lending interest from the commercial financial sector,

helping educate commercial banks about opportunities in the

financial sector as well as dispelling the perceived risks related

to WSS lending

9

. This messaging aligns directly with Water.

org’s model and helps propel the importance of finance-driven

solutions for the WSS challenge.

Beyond WaterCredit

Evidence from Water.org’s programs demonstrate that a

viable market can be made for financing water and sanitation

improvements. However, WaterCredit alone cannot make up

for the gap in financing that is needed to achieve SDG 6. To

expand and accelerate impact, Water.org has been developing

and testing new innovations on the central theme of financ-

ing for water and sanitation. These new approaches include

working with utility companies, the supply chain, and impact

investing to increase both the amount of financing mobilised

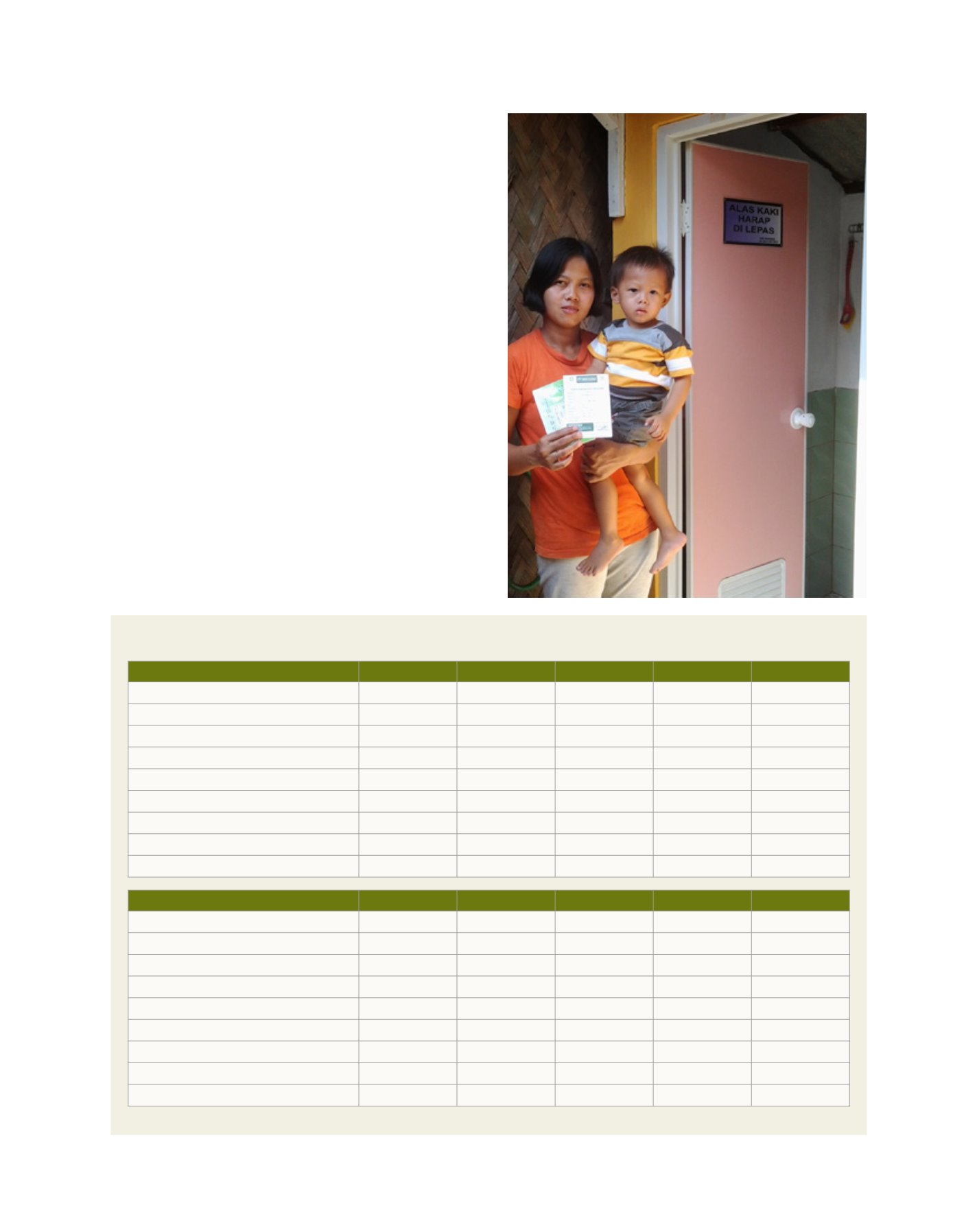

Bangladesh

India

Cambodia

Indonesia

Philippines

Number of WaterCredit loans

79,386

1,101,725

16,618

34,682

222,505

People reached

423,485

4,570,982

55,373

142,684

962,005

Women borrowers (%)

98

97

85

86

99

Loan amounts disbursed (US$)

20,181,906

220,640,074

7,368,529

8,264,689

47,952,863

Water.org grants to partners (US$)

2,644,573

11,012,189

436,940

1,315,857

673,536

US$ leveraged ratio

7.63

20.04

16.86

6.28

71.2

Cost per person (US$) – partner grant cost only

6.24

2.41

7.89

9.22

0.70

Average loan size (US$)

254

196

443

238

216

Average repayment rate (%)

98

99

-

99

99

Table 1: Key characteristics of loans disbursed under the WaterCredit program as of August 2017

Ethiopia

Ghana

Kenya

Uganda

Peru

Number of WaterCredit loans

322

149

77,326

2,740

109,203

People reached

1,977

17,121

439,010

68,653

423,177

Women borrowers (%)

43

38

55

45

47

Loan amounts disbursed (US$)

194,190

420,448

21,518,516

2,292,573

134,629,441

Water.org grants to partners (US$)

305,802

64,031

1,586,567

637,798

687,535

US$ leveraged ratio

0.64

6.57

13.56

3.59

195.81

Cost per person (US$) – partner grant cost only

154.68

3.74

3.61

9.29

1.62

Average loan size (US$)

603

2,822

278

837

1,233

Average repayment rate (%)

83

-

90

99

99

Source: Water.org

Image: Water.org