[

] 82

A B

et ter

W

or ld

contribute to food security. Research carried out for HSBC

by China Water Risk reveals that shifting cotton production

from the North China Plain could free up 1.5 million ha of

sown land area, which could be used to plant edible crops.

Alternatively, it could free up around 9.5 billion m³ of

virtual water for other uses. To put this into perspective, the

completed Phase I Eastern Route of the mega South-to-North

Water Diversion Project carries only 8.8 billion m

3

of water.

Another way of freeing up more water is through trade, by

importing more and exporting less water-intensive goods.

This could essentially change China’s export-led economic

growth model. Transitional risks abound as decisions that

are good for China may disrupt global trade and turn out to

be risks for others.

Global fashion could be one of those industries since China

is a major producer of key fashion raw materials – around a

quarter of global cotton and two-thirds of global synthetic

fibres. Sourcing problems aren’t as easily solved by moving to

other countries. India and Pakistan, ranked first and fourth

respectively as global cotton producers

2

, are also water stressed.

Closing the loop and going circular

Closing the loop also has potential as a solution. We need

circular economies that will reduce the use of virgin resource,

reduce waste, and increase recycling. To that effect, China has

mapped out plans of change for ten industries, some of them

are the most polluting in the country, textiles among them.

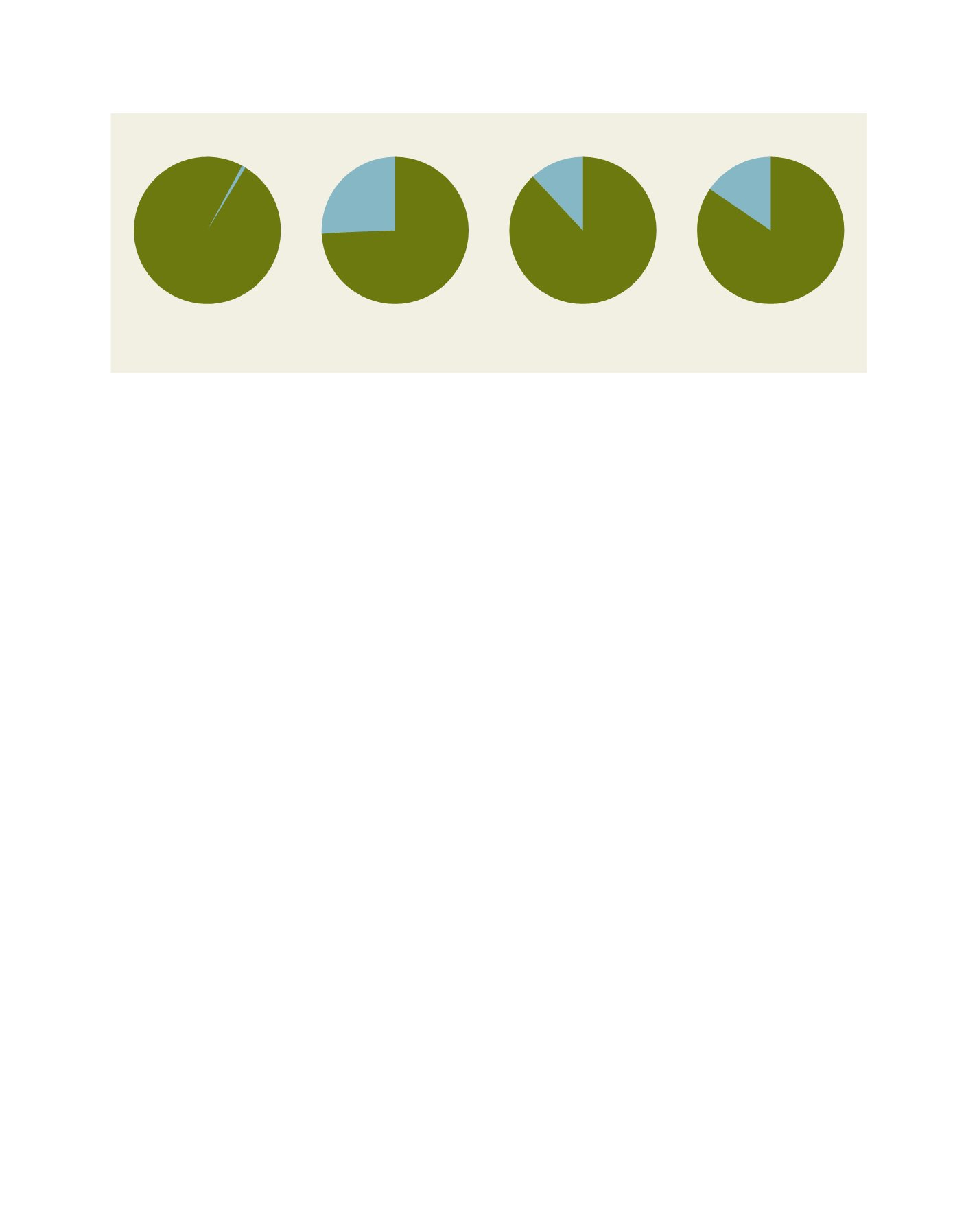

From a recent survey of 85 Chinese textile manufacturers,

it is evident that the transition has already started. 72% see a

business benefit in making the transition to a circular economy,

in addition to those manufacturers working to be compliant

with regulations. 98% of those surveyed said that they are

taking actions to be green (clean and compliant). Moreover,

74% recycle water, 88% have upgraded wastewater equipment

and 84% have upgraded equipment related to chemicals.

China’s national directives for the textile sector present a

unique period for the global fashion industry as the goals of

Chinese textile manufacturers and leading fashion brands

are converging. Both need to clean up and need/want to go

circular. The impetus for Chinese manufacturers is domestic

regulations, whereas the brands are facing greater scrutiny

over their environmental impact than ever before and uncer-

tainty about future supply of resources. As the majority of

key fashion raw materials are still produced in China, there

is an opportunity to set the foundations for a clean and circu-

lar business model. Actions on making this transition have

already begun.

Other industries, while not at the same tipping point as

textiles, face similar opportunities and risks as China cleans

up. Electronics is one such with its heavy reliance on the

country for key raw materials. It is estimated that 85–90%

of global rare earths, crucial for various electronic products

from smartphones to electric cars, are produced in China.

A recent report from CLSA

3

warns that smartphone brands’

current no-sense strategies, such as low recycling rates,

built-in obsolescence and poor repairability, serve only to

compound these risks. China is preparing to be future-ready

by securing critical raw material supplies, building a circular

economy and cleaning up pollution.

There is no circular model to copy and apply to textiles,

electronics, or to other industries, for China or for the world.

To go circular and ultimately ensure sustainable water for all

– municipal, agriculture and industry – we need new ways

of doing old things and a holistic approach. Simply put, we

need business unusual.

Our water future – climate change uncertainties

Water is both local and global. As the upper riparian, China’s

move to balance its economic development and environment

is a good start. In Asia, there are ten large rivers that flow

from the Hindu Kush Himalayan region. Known as the Third

Pole, the region is already being impacted by climate change,

bringing uncertainties in river flows that feed 16 Asian coun-

tries. With the water for over 1.3 billion Asians at stake, a

comprehensive water management approach by the entire

region is needed if SDG 6 is to be achieved, especially as

many of these countries are still developing. Urbanisation

rates, power use and resource demand are all on the rise.

It is therefore imperative at this water-energy-climate

nexus, that we choose the right type of power as well as

make sound business and policy decisions today for our

water tomorrow. Water is not simply encapsulated by SDG

6, it influences 11 other SDGs from poverty alleviation, zero

hunger, good health, clean energy, climate action, to respon-

sible consumption and production. The stakes are too high

not to achieve SDG 6.

Survey of 85 Chinese textile manufacturers

Recycle water

NO 26%

YES 74%

NO 12%

YES 88%

Upgraded wastewater

equipment

NO 16%

YES 84%

Upgraded equipment

related to chemicals

NO 2%

YES 98%

Manufacturers taking

action to become green

Source: China Water Risk report,

Insights from China’s Textile Manufacturers

, August 2017